Intro to Macroeconomics

# Intro to Macroeconomics

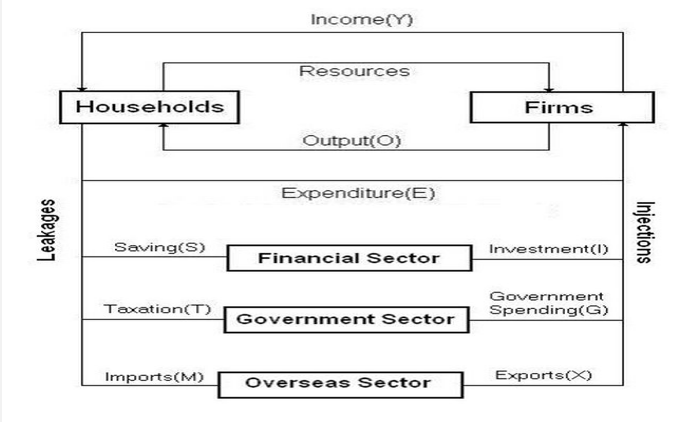

# Circular Flow of Income

Definition A Macroeconomic model that describes the flows of resources, goods and service, income and expenditure between different parts of the economy.

# Includes

- Firms

- Households

- Government

- Financial Sector

- Overseas

# Diagram of the CFI

# Households and Firms

# Assumptions

- Households own all the resources and are buyers

- Firms are employers and produce goods and services

- Factor market

- Product market

- The two markets are interdepended

# Injections and Leakages

# Injections

Definition Inflow of money into the circular flow of income

- Investment (I)

- Government Expenditure (G)

- Exports (X)

# Leakages

Definition Outflow of money from the circular flow of income

- Savings (S)

- Taxation (T)

- Imports (M)

# Equilibrium

- An economy is in equilibrium when the sum of all leakages = the sum of all injections

- Occurs when S+T+M = I+G+X

- Sum of all output (O) = Sum of all Expenditure (E) = Sum of all income (Y)

- All the income from households equals the expenditure on goods and services which equals the total production in the economy

# Changes to Equilibrium

# S>I

- Flow of Y must contract

- Total spending is less than output

- Inventories increases due to less expenditure

- Firms decrease production

- Households receives less income TBF

# Aggregate Expenditure

# Measuring Economic Performance

# GDP

- Expenditure approach

- Addition of all final expenditures within a country given a period of time

- National income approach

- Addition of al income earned from factors of production that produce goods and services given a period of time

- Output approach

- Addition of all value of goods and services produced in a country given a period of time

# Aggregate Expenditure

Definition Total amount that firms, households and government plan to spend on final goods and services at each level of income

- Calculated as AE = C + I + G + (X-M)

# Consumption

# Components

Households expenditure goods and services:

- Durables: >3 years

- Non-durables: <3 years

- Services

- Something else

# Factors Affecting Consumption

- Disposable income: More income = more spending

- Interest rates: High interest rates = more saving

- Availability of credit: More loans = more spending

- Stock of personal wealth: More wealth = more spending

- Expectations: Expecting economy downturn = more saving

- Government policies: Higher tax = less spending

# Private Investment

Definition Expenditure on producer or capital goods that are used to produce final goods and services in the future

# Investment by private firms

- Fixed investment (usually on capital goods)

- Residential fixed investment (private expenditure on new housing)

- Changes in business inventories (stocks of goods that have been produced but not sold)

# Factors Affecting Investment Expenditure

- Rate of interest (nominal vs real rates): Higher interest rates = less spending

- Business expectations

- Level of past profits (profitability)

- Government policies

# Government Expenditure

- All federal, state, local government expenditure

- 2 parts:

- G1: Current government expenditure on day to day functions

- G2: Government expenditure used for future needs

# Factors Affecting Government Expenditure

- Government policy objectives

- Current economic climate

# Net Exports

- Value of exports minus value of imports

# Factors Affecting Net Exports

- Exchange rates: $AUD increases = Imports decreases and exports increase

- Domestic and overseas economic activity: Aus doing well = Imports increase, overseas doing well = Exports increase

- Tariffs/Quotas: Higher tariffs = decrease